How AI is altering the panorama of insurance coverage claims processing – Insurance coverage claims processing is present process a major transformation, because of the arrival of synthetic intelligence (AI). AI is quickly altering how insurers deal with every part from preliminary experiences to closing payouts, streamlining the method and in the end benefiting each the insurer and the policyholder.

Historically, insurance coverage claims have been dealt with manually, a course of usually riddled with delays, inconsistencies, and potential for human error. However AI is automating many of those steps, resulting in quicker processing instances and improved accuracy.

How AI is altering the panorama of insurance coverage claims processing is multifaceted and profound. Think about a system that may immediately analyze photographs, paperwork, and even voice recordings to evaluate the validity of a declare, determine fraudulent exercise, and make quicker, extra knowledgeable choices. That is the facility of AI in motion.

Streamlining the Declare Course of

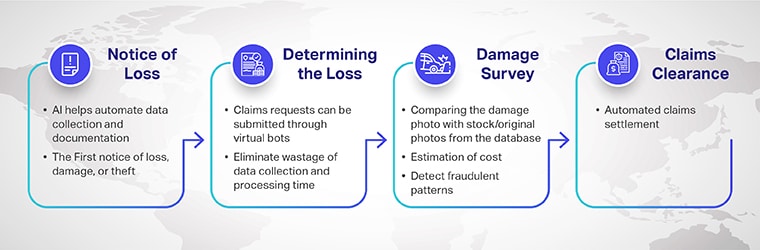

AI-powered programs can automate many essential steps within the claims course of, decreasing the time it takes to course of a declare from weeks to days. This interprets to happier policyholders and lowered administrative prices for insurers. For instance, AI can:

- Mechanically extract data from paperwork, akin to medical information or police experiences, decreasing the necessity for guide knowledge entry and bettering accuracy.

- Assess harm utilizing photographs and knowledge from drones or satellite tv for pc imagery to find out the extent of injury after a pure catastrophe. This may be extremely useful in assessing large-scale claims rapidly.

- Establish and flag potential fraud by analyzing patterns and anomalies in declare knowledge, which helps insurers stop fraudulent exercise and get monetary savings.

- Present personalised assist to policyholders, answering questions and guiding them by way of the claims course of.

Bettering Accuracy and Effectivity: How AI Is Altering The Panorama Of Insurance coverage Claims Processing

AI algorithms are educated on large datasets of historic claims knowledge, enabling them to determine patterns and anomalies that may be missed by human reviewers. This results in extra correct assessments and quicker declare approvals. AI’s potential to investigate huge quantities of knowledge may determine danger elements and predict future claims extra precisely, serving to insurers modify pricing and danger administration methods. It is a important step ahead from conventional strategies.

Supply: shaip.com

Moreover, AI can improve effectivity by automating duties like correspondence, communication, and follow-up, releasing up human brokers to concentrate on extra advanced instances. This results in important value financial savings and improved customer support.

Challenges and Future Outlook

Whereas AI provides important benefits, there are additionally challenges to contemplate. These embrace guaranteeing knowledge safety, sustaining regulatory compliance, and addressing issues about bias in algorithms. However ongoing developments in AI and machine studying are steadily addressing these points.

The way forward for insurance coverage claims processing seems promising. As AI know-how continues to evolve, we are able to anticipate much more refined and environment friendly programs, resulting in quicker declare settlements, lowered prices, and improved buyer satisfaction. The potential functions of AI within the insurance coverage business are huge and always increasing.

By embracing AI, insurers can higher serve their clients and improve their operations. It is a important shift in how insurance coverage corporations strategy claims, in the end making your complete course of extra streamlined and environment friendly. This progressive strategy might be vital to the way forward for the insurance coverage business.

Search Google for more information on AI in Insurance Claims